News & Stories

July 26, 2022

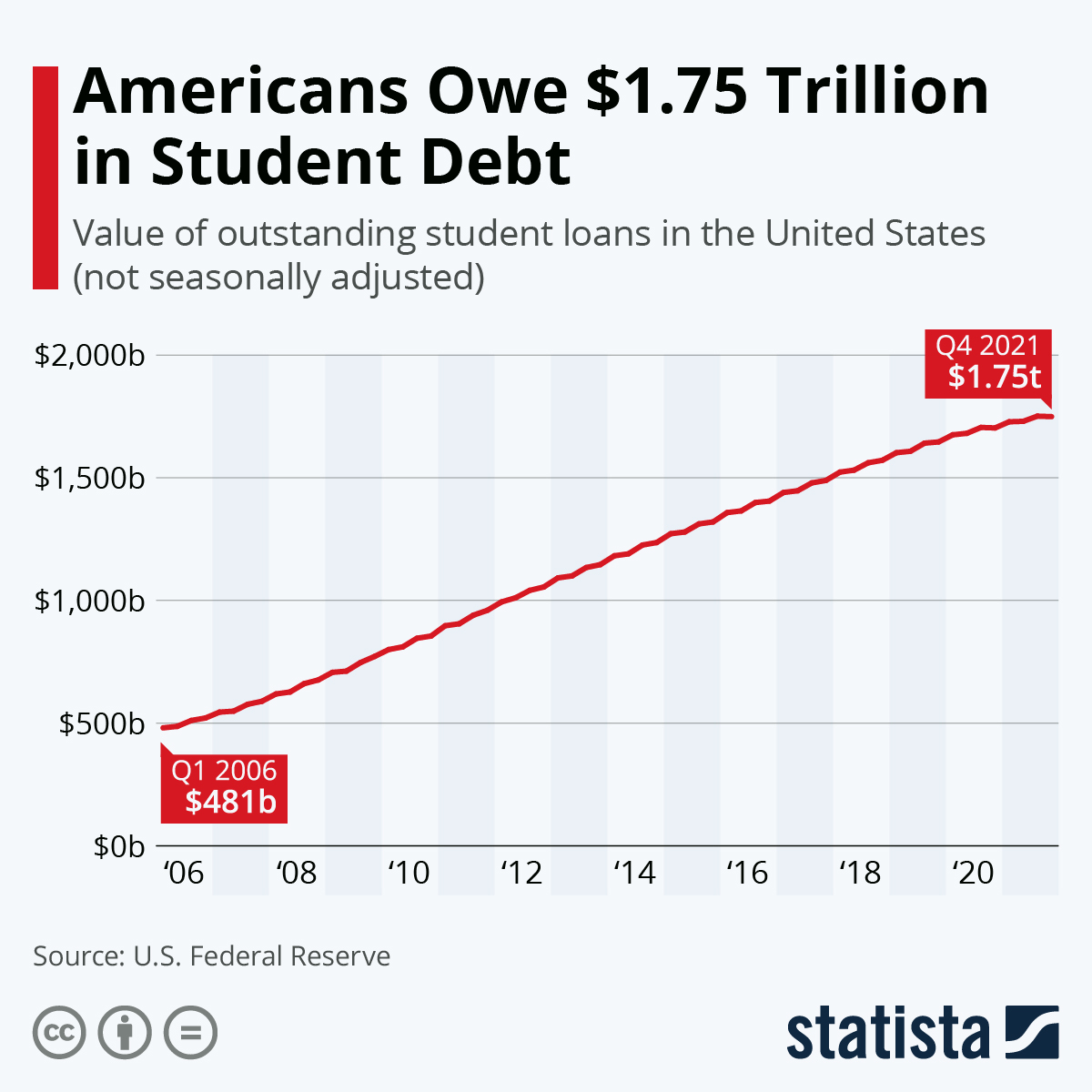

Student Loan Debt… when we hear this phrase nowadays, it can literally conjure up feelings of anxiety, regret and worry. For those without any student loan debt, it brings about confusion as to how such a crisis has gotten to the point where it is now. Student loan debt is such a real issue but not only for students but also for our economy as a whole as 47% of students default on their student loans and 53% of graduates cannot make the monthly payments as per the terms of their repayment schedule.

Let’s break this down:

The average college student comes from household that cannot afford to add a college expenses line to their family budget. This is not to say that on paper, some families can afford at least some college expenses. However, “on paper” can be very different from reality for so many families. Everyday expenses and then emergencies make it extremely difficult for families to pay for their student’s entire college education.

Now we cannot dismiss the fact that there are college and private scholarships that support quite a few of our students. However, not all students are in the top 5% of their graduating high school classes (huge qualifiers for academic scholarships) and not all students are living in households that fall below the poverty level (qualifiers for need-based scholarships). Let’s not even mention the fact that many scholarships, large and small, are extremely competitive. Kudos to the students that receive scholarships!!! But even with a scholarship or even multiple scholarships for some students, it is just not enough.

Consider this- US News and World Report described the current outlook for public and private institutions of higher learning noting that in the past 20 years, tuition at private colleges increased by 144%, by 171% at public colleges for out-of-state students, and by 211% for in-state residents at public colleges! This is outpacing the rate of inflation! Further, the average cost per year for a student to attend a public colleges and universities is $10,338 and $22,698, in-state and out-of-state, respectively, and $38,185 for private colleges. And of course we all know that there are institutions that can cost upwards of $65,000 per year!

To put this all into perspective as it relates to student loans, on average, a student is left with anywhere from $20,000/year to $35,000/year that is not covered by “free” money, that is, scholarships and grants. All these students want is an education. They understand that to move to the next level of their career (and in many careers), a college degree or higher is required. These students and their families are left with what seems to be the only viable choice- take out Federal or private loans.

This is why Dormoney was created. Dormoney Donors have the ability to ensure that our Students do not end up graduating with more debt than their first 3 years of a salary and monthly payments that they cannot afford. Even more, Dormoney Donors have the ability to ensure that our Students never have to choose between bettering themselves and their education and dropping out of school.

Students@Dormoney.com

Students@Dormoney.com